Bank of London CEO Anthony Watson Steps Down: A New Chapter for the Company

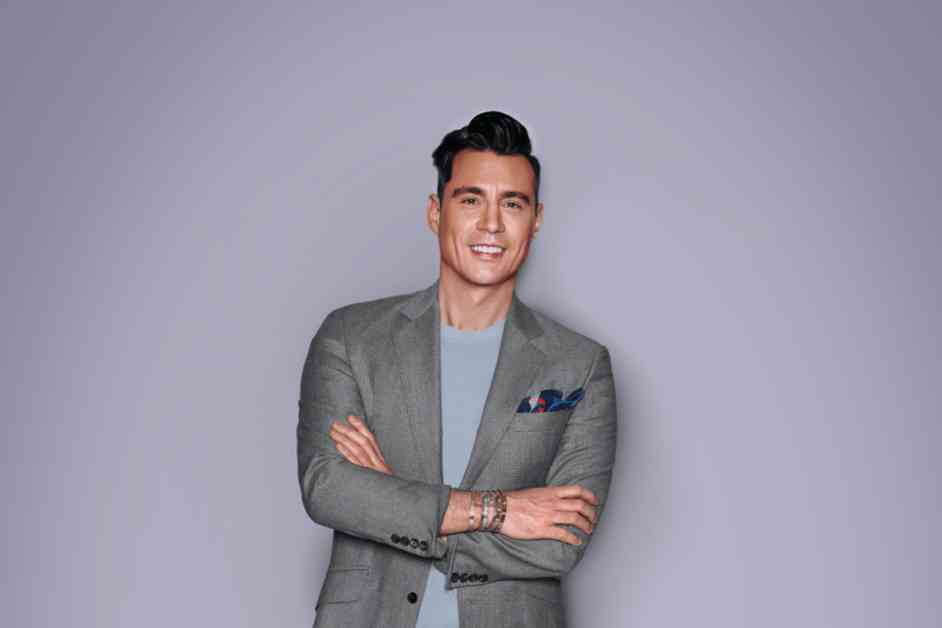

The Bank of London made headlines recently with the announcement of its founder and CEO, Anthony Watson, stepping down from his position after eight years at the helm. This move marks a significant transition for the challenger clearing bank, which Watson launched in 2021 as a purpose-built global clearing, agency, and transaction bank. As one of the few openly gay CEOs in the UK banking industry, Watson’s leadership has been instrumental in shaping the bank’s identity and success over the years.

Watson’s decision to transition into a new role as “founder & senior adviser” while remaining a non-executive director of The Bank of London Group reflects his commitment to the company’s continued growth and evolution. In his statement, Watson expressed gratitude for the opportunity to build The Bank of London from the ground up, emphasizing the personal significance of the bank as more than just a business venture.

The appointment of Stephen Bell as the new CEO of The Bank of London signals a new chapter for the company. Bell, who previously served as the chief risk and compliance officer, brings a wealth of experience from his time at the British Arab Commercial Bank. His leadership skills and industry knowledge will be crucial in guiding the bank through its next phase of development and expansion.

Reflecting on his new role, Bell expressed gratitude for the board’s confidence in his leadership and acknowledged Watson’s vision in creating The Bank of London. He emphasized his commitment to building on the foundation laid by his predecessor and leading the bank to continued success in the future. David Skillen, the firm’s UK chair, also praised Watson for his pioneering leadership and welcomed Bell as the new CEO, citing his extensive experience and understanding of the industry.

Financially, The Bank of London reported a pretax loss of £41.8 million in 2022, reflecting the costs of setting up infrastructure and expanding its workforce. Despite this setback, the bank has maintained its unicorn $1.1 billion valuation, thanks to a successful funding round led by Mangrove Capital Partners and 14W Venture Capital. This achievement speaks to the confidence investors have in the bank’s long-term potential and growth prospects.

Looking ahead, The Bank of London remains focused on serving its 4,500 businesses and clients with innovative banking products and services. The transition in leadership with Watson’s departure and Bell’s appointment signifies a strategic shift for the company, as it continues to navigate the evolving landscape of the financial industry. As the bank enters this new chapter, stakeholders will be watching closely to see how it adapts and thrives under new leadership.

The Legacy of Anthony Watson

Anthony Watson’s legacy as the founder and CEO of The Bank of London is a testament to his vision and dedication to building a unique and innovative banking institution. As a former Barclays executive, Watson brought a wealth of experience and expertise to the table when he launched the bank in 2021. His status as the only openly gay CEO in UK banking also made him a trailblazer in the industry, breaking barriers and paving the way for greater diversity and inclusion.

Under Watson’s leadership, The Bank of London quickly established itself as a challenger in the financial sector, offering a range of cutting-edge banking solutions to businesses and clients. The bank’s focus on global clearing, agency, and transaction services set it apart from traditional banking institutions, attracting a diverse clientele seeking modern and efficient financial solutions.

Watson’s decision to step down as CEO after eight years at the helm reflects his recognition of the need for new leadership and fresh perspectives to drive the bank forward. By transitioning into a new role as founder & senior adviser, Watson can continue to contribute his expertise and guidance to the company while allowing room for new leadership to take the reins.

The Appointment of Stephen Bell

As Stephen Bell assumes the role of CEO at The Bank of London, he brings a wealth of experience and a deep understanding of the banking industry to the table. Bell’s background as the chief risk and compliance officer positions him well to lead the bank through its next phase of growth and development. His track record of success and leadership skills make him a natural choice to succeed Watson as CEO.

Bell’s commitment to building on the foundation laid by Watson and continuing to drive the bank’s success is evident in his statements following the announcement of his appointment. He expressed gratitude for the board’s confidence in his leadership and emphasized his excitement at the opportunity to lead the bank into the future. With a solid team in place and a clear vision for the bank’s growth, Bell is poised to steer The Bank of London towards continued success in the years to come.

The Future of The Bank of London

With a new CEO at the helm and a commitment to innovation and growth, The Bank of London is poised to enter a new chapter in its evolution as a challenger clearing bank. The transition in leadership from Anthony Watson to Stephen Bell marks a strategic shift for the company, as it navigates the challenges and opportunities of the financial industry.

Despite facing a pretax loss in 2022, The Bank of London has maintained its unicorn $1.1 billion valuation, indicating strong investor confidence in the bank’s long-term potential. The successful funding round led by prominent investors further underscores the bank’s position as a key player in the fintech sector, with a focus on delivering innovative banking solutions to businesses and clients.

As The Bank of London continues to serve its growing customer base and expand its global capabilities, stakeholders will be watching closely to see how the new leadership under Stephen Bell drives the bank’s growth and success. With a strong foundation in place and a commitment to excellence, the bank is well-positioned to capitalize on emerging opportunities and solidify its position as a leader in the financial industry.