China Stock Market Surges Due to FOMO – 16-Year Record Growth

The global stock market saw a significant surge after China announced measures to inject another £100bn into its economy, causing European markets to rally. Investors across the UK, France, Germany, and Italy are gearing up for a positive opening following the major gains in China and Hong Kong stocks, marking their strongest weekly performance since 2008.

The People’s Bank of China took a bold step by cutting the amount banks are required to hold in reserve, releasing an estimated $142.6bn (£106.6bn) in liquidity into the financial market. This move is part of China’s efforts to stimulate growth and revitalize its economy, which has been facing challenges in recent years.

China’s Stimulus Measures

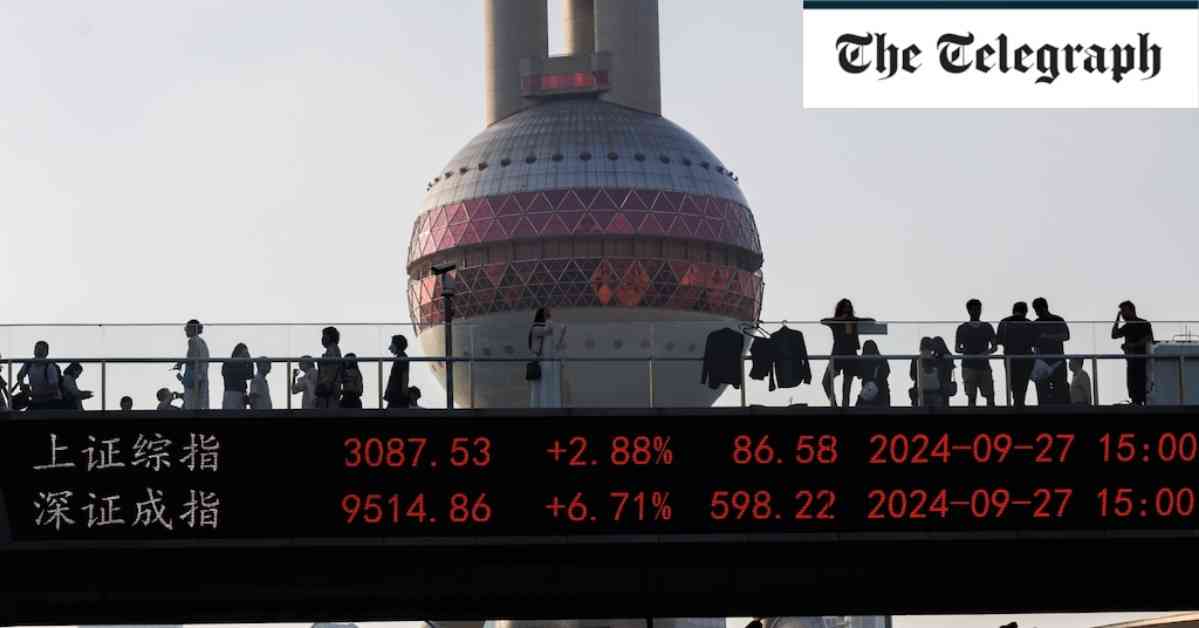

China’s benchmark CSI 300 Index is on track to achieve its biggest weekly gain since 2008, reflecting the confidence in the country’s economic prospects. The government has also pledged to increase fiscal support and stabilize the property sector to boost growth. The Hang Seng in Hong Kong surged 3.7%, while the Shanghai Composite index jumped 2.1%, indicating a positive sentiment among investors.

However, the Shanghai Stock Exchange experienced technical glitches that disrupted order processing and caused delays in trading. This led to a surge in the Shenzhen index, as investors sought opportunities in the smaller market during the downtime. The exchange later clarified that it was investigating the causes of the disruptions, and normal trading resumed by noon.

Global Market Reaction

The positive momentum in Asia spilled over to other markets, with Japan’s Nikkei 225 index rising more than 1% as the ruling Liberal Democratic Party conducted a leadership election. The outcome of the election is expected to have minimal impact on policy decisions, given the similarities among the leading contenders. Australia’s S&P/ASX 200 also saw gains, while South Korea’s Kospi experienced a slight decline.

On Wall Street, the S&P 500 achieved a record closing high, with the Dow and Nasdaq also posting gains. The positive performance in the US markets reflects the overall optimism surrounding global economic recovery. The yield on 10-year US Treasury notes rose slightly, indicating confidence in the financial markets.

Implications for Investors

The surge in the Chinese stock market has sparked a fear of missing out (FOMO) among investors, as they scramble to capitalize on the momentum. The injection of liquidity by the People’s Bank of China has provided a boost to the economy and sent positive signals to the global market. However, investors should exercise caution and conduct thorough research before making investment decisions to mitigate risks.

In conclusion, the recent rally in the Chinese stock market and its ripple effects on global markets highlight the interconnected nature of the financial world. As economies continue to recover from the impact of the pandemic, proactive measures like those taken by China play a crucial role in restoring confidence and driving growth. Investors should stay informed and adapt to changing market dynamics to make informed investment choices.